Research Article

Volume 1 Issue 1 - 2017

Goat Value Chain Analysis in Pastoral Communities of Ethiopia

1Ethiopian Institutes of Agricultural Research, Werer Agricultural Research Center, Department of Agricultural Economics, Extension and Gender Research, Addis Ababa Ethiopia

2Department of Agricultural and Resource Economics, Colorado State University and East African Coordinator, Feed the Future Innovation Lab: Adapting Livestock System to Climate change U.S.A

2Department of Agricultural and Resource Economics, Colorado State University and East African Coordinator, Feed the Future Innovation Lab: Adapting Livestock System to Climate change U.S.A

*Corresponding Author: Aklilu Nigussie, Ethiopian Institutes of Agricultural Research, Werer Agricultural Research Center, Department of Agricultural Economics, Extension and Gender Research, Addis Ababa Ethiopia.

Received: May 23, 2017; Published: June 16, 2017

Abstract

This research investigates the value chain of goat supply in the pastoral communities of Ethiopia. The Objectives were to identify the main stages in the value chain and the constraints limiting its full functioning. To achieve the objective stated; primary and secondary data were used. Marketing system was evaluated using structure, conduct and performance approach; furthermore; co-integration and error correction model for market integration. Multiple linear regression models were fitted to identify factors contributing to the variation of price per kg of live weight. Price information for three years (2013, 2014 and 2015) average monthly base was used. The total sample take was 1200 household pastorals. A result of the study average family size was found 7.1, 4.3 and 5.7 for Afar, Oromia and Somalia respectively. For Dummy variable marital status was found a chi-square level (11.45) which indicates a significant difference among the sample regions at level 5% while education difference was significant at level 1% (19.49). The mean average age of household head was found 40.4 for Afar, 32.6 Oromia and 28.1 Somalia yet total average age of the sample was found 34.7 and the difference was found significant with t-value of (3.81). Average years of experience of was found 20.3, 28.6 and 14.9; on the other side average annual income in Ethiopian Birr (at the time the survey the exchange rate was 20.4 Ethiopian birr = ± 1 US dollar) from sales of live goat was found 5,521, 9,271 and 13,465 for Afar, Oromia and Somalia consecutively.

Market information is important for trading activities so the pastoral from Afar 41.4% had primary market information while 2.5 secondary market information yet this in Oromia was 74% and 28.1% while it was 88% and 14.8% in Somalia none of the sample region had information on tertiary market. The average flock sizes was found 11.8 (std. dev = 33.8) per house-hold while average annual supply was found to be 2.7 (std. dev = 1.9). Actors in chain were found as pastorals, input suppliers, district butcher, restaurants, district fatteners, district traders, retailers, subnational traders, national traders, exporters, Enablers and facilitators. In Amibara (Afar) the highest concentration of the four trader that bought heads of goat share controlled over 91% from total bought in the market fiscal year, while in Babilie (Somalia) and Fentale (Oromia) 84% and 71%. The average marketing cost incurred per head of goat for regional whole sealers was found 71.16 Eth. Birr/head while 31.11, 27.5 and 57.65 Eth. Birr/head of goat was for retailers, pastorals and pre-urban assemblers’ consecutively in the sample regions. The marketing margin for the second rout-to Addis Ababa is expensive than compare to the first rout Amhara and Tigray.

Keywords: Goat; Marketing margin; Average marketing cost; Value chain; Spatial market price integration

Introduction

Goats are distributed all over the world because of their great adaptability to varying environmental conditions and nutritional. Their productivity, small size and non-competiveness with human for food make them to be domesticated. As indicated by the archaeological evidence, they have been associated with human in a symbiotic relationship for about 10,000 years (Ensminger and Parker, 1986). Goats are the most prolific domesticated ruminants; producers are increasingly relying on goats as means of survival and a way of boosting their income (Peacock, 2005). They can withstand heat stress and can endure prolonged water deprivation; additionally great adaptability to adverse climatic and geophysical conditions, where cattle and sheep cannot survive. Moreover goats can efficiently utilize poor quality forage; their peculiar feeding habits make it easier to choose diets to meet their requirements. It is also learned that farmers and pastoralists are increasingly relying on goats as means of survival and a way of boosting their income (Peacock, 2005).

The increasing frequency of droughts, with long-term environmental degradation is causing pastoralists to rely the production system to camels or goats. Goat enterprises suit the landless, marginal and small farmers equally since it provides substantial income and helps to create employment to the pastoral including women and children with comparatively low input demanding. Moreover, goat is regarded as the handy source of money in need and is considered as the living bank for marginal and small farmers to supply the immediate need of cash. Indeed several reasons make goats particularly attractive for poverty reduction and improvement of family food security and livelihood of the poor in developing countries.

There are, however, several challenges associated with increasing demand in urban and cities demand for meat and live animal production including consumer and producers, live goat for slaughter and meat exporters, lack of information for markets development and developed marketing channels. The potential importance of this research is to feel the gap with its extent of contribution to the livelihood of the pastoral communities and for further research and development intervention. Despite its potential of goat production in the pastoral communities, yet; there is a dearth of literature to guiding government, donor and the private sector in making investment decisions on how the goat sector functions, and how it can be improved. This paper seeks to fill in this gap through a detailed value chain analysis of the sector.

Objective: To identify main stages in live goat value chain, constraints limiting its full operative and price trends, in order to establish scientifically reliable information pastoral communities in Ethiopia.

Methodology

Study area

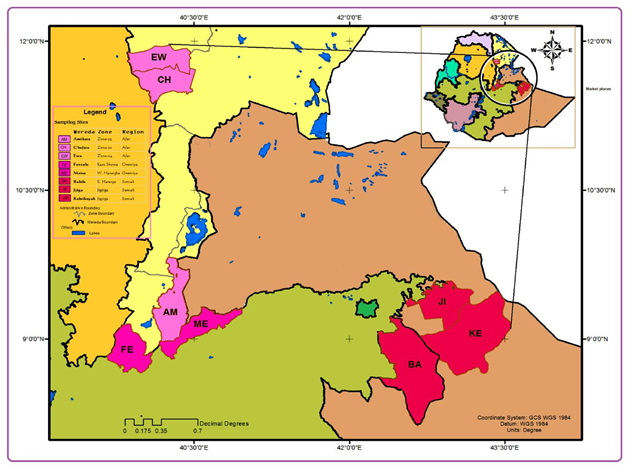

The study region include Afar, Oromia and Somalia regional state of Ethiopia with different sample districts which were spatial distributed by two northeast to north and East to west corridors: Somalia, Oromia, Afar to Amhara (Woldia)-Tigray (Channel I) and Somalia-Afar-Oromia to Addis Ababa (channel II). This study considered 8 market centers and 6 production districts along the major two road corridors.

The study region include Afar, Oromia and Somalia regional state of Ethiopia with different sample districts which were spatial distributed by two northeast to north and East to west corridors: Somalia, Oromia, Afar to Amhara (Woldia)-Tigray (Channel I) and Somalia-Afar-Oromia to Addis Ababa (channel II). This study considered 8 market centers and 6 production districts along the major two road corridors.

Data Collection and Analysis

The research applied qualitative and quantitative data. Time series data were collected to indicate the implication of market price on supply integration and trend analysis with spatial differences. Steps taken in data collection and analysis were:

The research applied qualitative and quantitative data. Time series data were collected to indicate the implication of market price on supply integration and trend analysis with spatial differences. Steps taken in data collection and analysis were:

Preliminaries: review of literatures and consultation with district pastoral offices. Separate sets of questioners for pastoral, traders and stakeholders were developed.

Data Collection: Prior to commencing ground study, an inception discussion was conducted at Chifra, Jigjiga, and Fentale district which provided insights on concept and scope the research. Interviews, focus group discussions (FGDs), observations, stakeholders’ consultations were done.

Data Generation: Data were analyzed systematically in order for scientific regression. Value chain map of the system is drawn. Economic analysis for market integration cost of production and distribution of margin along the chain were analyzed.

Structure-Conduct-Performance

Markets are complex institutions encompassing hierarchies and interlinked transactions, which may involve simultaneous considerations of various commodities (Plaskas and Hariss, 1995). As Scott (1995) argued, performances and integration of markets are the results of actions of traders and of the operating environment determined by the infrastructure available.

Markets are complex institutions encompassing hierarchies and interlinked transactions, which may involve simultaneous considerations of various commodities (Plaskas and Hariss, 1995). As Scott (1995) argued, performances and integration of markets are the results of actions of traders and of the operating environment determined by the infrastructure available.

To study function of markets, many researchers have applied "structure-conduct-performance"(SCP) paradigm. The methodology was elaborated by Bain (1968) to evaluate performance of industries in USA. Subsequently, it was applied in studies on the functioning of markets in agricultural sector and served as a tool to evaluate the performance of the business (Rangaswamy, 2002). Hence, this research looked up on the structure-conduct-performance pattern in a framework analysis.

Structure

Market structure depicts the institutional environment where transactions take place, which influences competition and pricing. It is defined as characteristics of the organization, to influence strategically competition and pricing within (Clemence and Maria 1994). According to Scott (1995), elements types are: intermediaries, channels, markets, actors, instruments or standards, physical infrastructure and regulation of entry and exit.

Market structure depicts the institutional environment where transactions take place, which influences competition and pricing. It is defined as characteristics of the organization, to influence strategically competition and pricing within (Clemence and Maria 1994). According to Scott (1995), elements types are: intermediaries, channels, markets, actors, instruments or standards, physical infrastructure and regulation of entry and exit.

Concentration Ratio

The concentration ratio is expressed in the terms CRX, which stands for the percentage of the market sector controlled by the biggest X firms. Four firms (CR4); it is the most typical for arbitrating structure (Kohls&Uhl, 1985; Shughart, 1990). A CR4 of over 50% a tight oligopoly; CR4 25 to 50 considered a loose oligopoly. A CR4 fewer than 25 is no oligopoly; CR3 of over 90% or CR2 of over 80% should be considered a super tight oligopoly.

The concentration ratio is expressed in the terms CRX, which stands for the percentage of the market sector controlled by the biggest X firms. Four firms (CR4); it is the most typical for arbitrating structure (Kohls&Uhl, 1985; Shughart, 1990). A CR4 of over 50% a tight oligopoly; CR4 25 to 50 considered a loose oligopoly. A CR4 fewer than 25 is no oligopoly; CR3 of over 90% or CR2 of over 80% should be considered a super tight oligopoly.

The econometrical formulation for concentration ratio (CR) is:

CR = Σin Pi i= 1, 2, 3, …, r 1

CR = Σin Pi i= 1, 2, 3, …, r 1

Where:

CR is the goat market concentration ratio

n is the number of large goat firm for which the ratio is going to be calculated

Pi is the percentage of market of the ith goat firm

CR is the goat market concentration ratio

n is the number of large goat firm for which the ratio is going to be calculated

Pi is the percentage of market of the ith goat firm

Conduct

According to Bain (1968); conduct refers to patterns of behaviour that firms follow in adopting or adjusting to markets in which they sell or buy. Such a definition implies the analysis of human behaviour patterns that are not readily define, obtainable, or quantifiable.

According to Bain (1968); conduct refers to patterns of behaviour that firms follow in adopting or adjusting to markets in which they sell or buy. Such a definition implies the analysis of human behaviour patterns that are not readily define, obtainable, or quantifiable.

Performance

It refers to economic flow from the industry as an aggregate of firms. As Bressler and King (1970) argued, performance refers to impact of structure and conduct as measured in terms of variables such as prices, and supply by analysing level of marketing margins and their cost components, it is possible to evaluate impact of structure and conduct characteristics on market performance (Bain, 1968).

It refers to economic flow from the industry as an aggregate of firms. As Bressler and King (1970) argued, performance refers to impact of structure and conduct as measured in terms of variables such as prices, and supply by analysing level of marketing margins and their cost components, it is possible to evaluate impact of structure and conduct characteristics on market performance (Bain, 1968).

In this study, goat market performance was evaluated based on two indicators; margin and integrations.

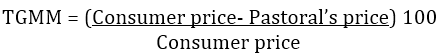

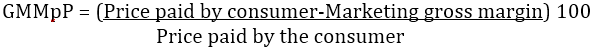

Goat market margins: As Mendoza (1995) argued, when there are several participants in the chain, live goat margin was calculated by finding price variations at diverse segments and comparing with final price to consumer. Consumer price was then base or common denominator for marketing margins. Computing gross marketing margin (TGMM) was always related to the final price or the price paid by end consumer and expressed as a percentage.

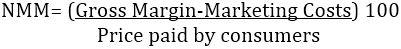

Net marketing margin: In a chain with only one trader between producers and consumers, net marketing margin (NMM) was the percentage over final price received by intermediary as his net income once costs are deducted

Where:

TGMM is the total gross marketing margin for goat

GMMp is the gross marketing margin of pastorals (producers or suppliers)

NMM is the net marketing margin for goat

TGMM is the total gross marketing margin for goat

GMMp is the gross marketing margin of pastorals (producers or suppliers)

NMM is the net marketing margin for goat

Gross margin is a profit divided by sales revenue or gross profit divided by net sale revenue, expressed as percentage (Encarta, 2015).

Asfaw (1998) stated that there is no decisive statistical ground model specification among alternatives.

As he further noted, recent studies are commonly using regression models to estimate supply function. Likewise for this research, OLS regression has been fitted to analyse and estimate supply of goat in sample regions.

Linear Ordinary Least Squares Regression Econometric Model Specification:

Following Guajarati (2004) the OLS regression is specified as:

S = f (price, inputs, formal education, sheep number, goat number, accesses to extension, credit services, distance to market, time of selling, etc...).

Si = αi + ßiXi + Ui 5

Where:

Si = Local market supply

αi = Intercept

ßi = Coefficient of ith variable

Xi = Explanatory variables

Ui = Error term

Si = Local market supply

αi = Intercept

ßi = Coefficient of ith variable

Xi = Explanatory variables

Ui = Error term

Price transmission

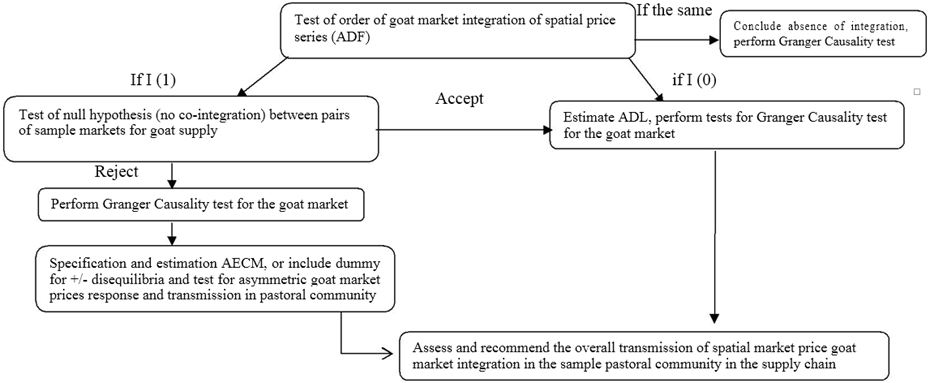

Price transmission lacks a direct unambiguous empirical counterpart in form of single testing. It encompasses cases of perfect market integration, inherent dynamic interactions that arise due to inertia or discontinuities, as well as non-linearity that may arise due to different macro and micro distortions in arbitrage. More importantly, it implies hypotheses, through its components, that are testable within a co-integration-error correction model framework. A number of time series techniques can be used to test each of the components transmission and ultimately assess extent of price. These are as follows:

Price transmission lacks a direct unambiguous empirical counterpart in form of single testing. It encompasses cases of perfect market integration, inherent dynamic interactions that arise due to inertia or discontinuities, as well as non-linearity that may arise due to different macro and micro distortions in arbitrage. More importantly, it implies hypotheses, through its components, that are testable within a co-integration-error correction model framework. A number of time series techniques can be used to test each of the components transmission and ultimately assess extent of price. These are as follows:

Co integration: the concept of co-integration (Granger, 1981) and the methods for estimating was related to (inter alia Engle and Granger, 1987; Johansen, 1988, 1991, 1995) provide a framework for estimating and testing long run equilibrium concerning non stationary.

If prices spatially separated P1t and P2t contain stochastic trends and integrated of the same order, say I (d), prices are said to be co-integrated if:

P1t - βP2t = Ut Is I (0). 6

Causality: causation in price information flow was tested by Granger causality; it was used to establish the existence of a central market (Nazreat market in Oromia regional state and Weldia market in Amhara regional state) (Granger, 1969). Unless the expected goats flow, the test for the information flow was conducted in both directions for all the sample market pairs. This is important because more than one model of price formations could coexist in a marketing system. Prices could be formed by both the assumed central and district local markets, because local markets could form prices based on the price formed the central market. Local markets could fix prices in collusion or cooperative way (Palaskas and Harris, 1993). Information could flow from district local to local markets. The test was used to identify direction of relationship between pairs of goat market. This requires considering the ten bi-variate autoregressive equations (the thirty six pairs) of the ten (Amibara, Chifra, Fentale, Meiso, Babilea and Jigjiga) (Nazareth and Weldia for central market analysis) sample market, but estimation for price flow was conducted in both directions of the market pairs.

Error correction mechanism; concept of co-integration has an important implication, purported by Granger Representation Theorem (Engle and Granger, 1987); which states that if two trending, say I (1), variables are co-integrated, their relationship may be validly described an Error Correction Model, and vice versa. In case those prices from two spatially separated markets, P1t and P2t, are co-integrated, Vector Error Correction representation can be applied to the time series data collected of the goat price.

The above tests were taken to present evidence about components of transmission providing particular insights of goat market chain. These techniques illustrate framework for assessment of price transmission and integration.

The error correction provides a framework for testing symmetric and nonlinear adjustment to long run equilibrium. Granger and Lee (1989) proposed an asymmetric ECM (AECM) where speed of adjustment of endogenous variable depends on whether deviation from the long run equilibrium is positive or negative. Single asymmetric ECM is specified as follows:

- For each pair of goat market prices, tested for order of integration price, utilizing the ADF (Dickey and Fuller, 1979). In event that the series have a different order of integration, conclude are not integrated. In case series are found to be I (0), resort to assessing dynamics of correlation by means of Autoregressive Distributed Lag (ADL) models. Test for Granger Causality within a Vector Auto regression (VAR) framework to assess transmission between markets or along the supply chain of goat in the pastoral community.

- In the event tests indicate series are integrated of same order (say I (1)), proceed by testing the null of non-co-integration against alternative hypothesis of one test for null of non-co-integration following Engle and Granger (1987). Evidence against null of no co-integration is taken to indicate that prices sample market co-move and states markets are integrated.

- Tests indicating price series are co-integrated, proceed by focusing on the error correction representation, in the form of a (V) ECM and on examining short run dynamics, speed of adjustment and direction of Granger causality in short or long run following Granger (1969, 1988) with sample taken in time series of data are applied to pastoral communities of Ethiopia.

- Based on our results on direction of causality, specify AECMs and test for null of symmetry following Granger and Lee (1989) or Prakash, Oliver and Balcombe (2001). Finally, discuss results and recommendations on nature of price transmission and market integration of pastoral communities of Ethiopia in focus of goat market price.

In this research; outline does not identify factors that affect market integration and price transmission. This are not able to distinguish price transmission and market integration is shaped by transaction costs, policy intervention that insulates domestic markets, or degree of market power exerted by agents or traders in supply chain or any other heterogeneous factors. For this reason, an attempt is made to complement results with some qualitative information on major factors that may determine extent of transmission like age, grade, color and sex of the animal.

Result and Discussions

The result part on goat value chain analysis particularly, on marketing channels, and the spatial market function using goat price integration.

Descriptive analysis

The dummy variables of pastoral defined in terms of household head sex, marital status, education level, age, and family size are presented on Table1. Sex of sample households was comparable for three sample regions (Afar, Somalia and Oromia) and 96.5% of sample household were male. With regard to marital status, 43.8% total sample respondents are polygamy; however, there is a significant difference among sample regions 55.5% was in Afar while 27.8% were in Oromia of the total sample 450 and 300 household respondents. Table 1 show that chi-square test for marital status of three regions was found to be significant at less than 5% significance level.

The dummy variables of pastoral defined in terms of household head sex, marital status, education level, age, and family size are presented on Table1. Sex of sample households was comparable for three sample regions (Afar, Somalia and Oromia) and 96.5% of sample household were male. With regard to marital status, 43.8% total sample respondents are polygamy; however, there is a significant difference among sample regions 55.5% was in Afar while 27.8% were in Oromia of the total sample 450 and 300 household respondents. Table 1 show that chi-square test for marital status of three regions was found to be significant at less than 5% significance level.

The educational background of the household head in the sample district believed to be an important to examine the available information in the production and supply side of goat to the value chain system. From the aggregate sample taken in Afar regional state of 450 pastoral household head 96.6% of were found to be illiterate while the sample from Somalia and Oromia taken 450 and 300 pastoral households heads they found to be 65.1% and 81.8% were illiterate. Chi-square indicates there is a significance difference between three sample regions at1% significant level in pastoral household educational level.

| Variables | Afar (Amibara, Chifra and Ewa) | Oromia (Meiso and Fentale) | Somalia (Jigjiga Bebilea and Kebribeyah) | Total N = 1,200 |

- |

| N = 450 | N = 300 | N= 450 | |||

| Sex | |||||

| Female | 3.6 | 4.8 | 2.2 | 3.5 | 1.27 |

| Male | 96.4 | 95.2 | 97.8 | 96.5 | |

| Marital status | |||||

| Single | 7.1 | 13.9 | 14.7 | 11.9 | 11.45** |

| Married | 33.2 | 50.3 | 33.8 | 39.1 | |

| Polygamous | 55.5 | 27.8 | 48.2 | 43.8 | |

| Widow | 3.7 | 5.6 | 3.3 | 4.2 | |

| Divorced | 0.5 | 2.4 | 0 | 1.0 | |

| Educational level | |||||

| Illiterate | 96.6 | 81.8 | 65.1 | 81.2 | 19.49*** |

| Religious school | 2.3 | 9.9 | 18.4 | 10.2 | |

| Elementary | 1.1 | 7.2 | 11.9 | 6.7 | |

| High school | 0 | 1.1 | 4.6 | 1.9 | |

| Age of HH | 40.4 | 32.6 | 28.1 | 34.7 | 3.81*** |

| (12.03) | (15.4) | (13.2) | (13.6) | ||

| Family size | 7.1 | 4.3 | 6.2 | 5.7 | 2.01** |

| (2.1) | (2.2) | (2.8) | (2.4) |

Note: N is the sample size; Numbers in parenthesis indicate standard deviation

***, **, and *are significant level less than 1%, 5%, and 10% Source: Survey result, 2014/15.

Table 1: Demographic characteristics of sample households (% and average).

***, **, and *are significant level less than 1%, 5%, and 10% Source: Survey result, 2014/15.

Table 1: Demographic characteristics of sample households (% and average).

Mean age of pastoral household head in Afar, Oromia and Somalia were found 40, 33 and 28 respectively from the taken sample. The sample t-test for continues variable states that there is a significant difference at 1% with the value (3.81) Table 1.

Table 2 portrays the pastoral household head average years of experience in sales of got to the nearby market. Outcome of the analysis affirms that average years of experience of pastoral household head in marketing goat was (21.8 years). Yet there exists a difference of experience years among the sample region while Oromia recorded 28.6 years which is the largest compare to Afar and Somalia sampled pastoral household heads. Experience contributes to bargaining power, market information analysis and seasonal price forecast for the household in supplying goat to the nearby market with such condition the sample households head from Oromia can have more advantage compare to the rest sample pastorals. Average annual income from the sales of goat was found 9,431 Ethiopian Birr; pastoralist supplies to market is not only goat yet sheep, came and cattle are other sources of income in addition to off farm income which subsidizes the household families.

| Afar (Amibara, Chifra and Ewa) N= 450 |

Oromia (Meiso Bebilea and Fentale) N= 300 |

Somalia (Jigjiga and Kebribeyah) N= 450 |

Total N= 1,200 |

X2 and t value | |

| Average years of experience | 20.3 (11.5) | 28.6 (13.8) | 14.9 (9.1) | 21.8 (11.6) | 2.51** |

| Average annual income of sales | 5521 (1266) | 9271 (1492) | 13465 (1812) | 9431 (1527) | 4.32*** |

Note: Note: N is the sample size; Numbers in parenthesis indicate standard deviation; Income is in Ethiopian Birr (at the

time of the analysis 20.4 Ethiopian birr equivalent to 1 US dollar)

***, **, and * are significant level less than 1%, 5%, and 10% Source: Survey result, 2014/15.

Table 2: Experience in sale and income.

***, **, and * are significant level less than 1%, 5%, and 10% Source: Survey result, 2014/15.

Table 2: Experience in sale and income.

Accessing the right information makes household to have a concrete base for decision that can affect the supply side of goat and production process. Having reliable information can determined the when and where to supply of the live goat. Keeping constant of other variables and different heterogeneous factors of supply market information can weight in affecting the supply side. Table 3 revealed that 68.2% of the total sample has information of the primary market in the nearby district yet there exist a variation among the sample regions which is a significant level chi-square (12.7) at the level of 1%.

| Variables | Afar (Amibara, Chifra and Ewa) N = 450 |

Oromia (Meiso Bebilea and Fentale) N = 300 |

Somalia (Jigjiga and Kebribeyah) N = 450 |

Total N = 1,200 |

X2 and t value |

| Information primary market (Yes) | 41.4 | 74 | 88 | 68.2 | 12.7*** |

| Information secondary market (Yes) |

2.5 | 28.1 | 11.9 | 14.8 | 20.1*** |

| Information tertiary market (Yes) | - | - | - |

Note: N is the sample size; __is the chi-square test

Source: ***, **, and * are significant level less than 1%, 5%, and 10% Survey result, 2014/15

Table 3: Access to market information.

Source: ***, **, and * are significant level less than 1%, 5%, and 10% Survey result, 2014/15

Table 3: Access to market information.

Table 3 depicts sample households of 1,200 pastorals have no access of information in the tertiary market of Nazareth and Addis Ababa which indicates that information concentrated areas are on the district market this intern affect the price set and can create arbitrage, supply and demand shock. Disruption of market equilibrium can cause by a change in a demand and supply determinant. Market shock can take one of four forms i.e. demand increase, demand decrease, supply increase, or supply decrease. An increase is seen as a rightward shift of either curves or results an increase equilibrium quantity supply. A decrease is a leftward shift of either curve results in decrease equilibrium. However, a change in demand results in price change in direction, while a change in supply causes equilibrium price to move opposite direction.

Principal inputs use

Increasing productivity directly or vice versa making the most efficient effective use of inputs throughout the production process to meet the growing demand for the quality supply of goat. Incremental productivity with small and medium scale pastoral production system is constrained by lack of access to inputs and capacity to purchase them, appropriate technologies, compounded with inefficient market access to information.

Increasing productivity directly or vice versa making the most efficient effective use of inputs throughout the production process to meet the growing demand for the quality supply of goat. Incremental productivity with small and medium scale pastoral production system is constrained by lack of access to inputs and capacity to purchase them, appropriate technologies, compounded with inefficient market access to information.

Pastorals in sample region apply traditional goat production; technologies like improved goat, fattening techniques etc., are not used. Insignificant producers exercise on fodder supply bought from the nearby primary markets and access to medication. Better access in fodder and medical treatments was observed Somalia regional state of as compared to Afar and Oromia samples as 39.9, 38.5, and 21.6 percent respectively (Table 4).

| Sample Regions | % Improved Input Access |

| Afar (Chifra, Ewa and Amibara) | 38.5 |

| Oromia (Meiso, Bailea and Fenatle,) | 21.6 |

| Somalia (Jigjiga and Kebribeyah) | 39.9 |

Source: Survey result, 2014/15.

Table 4: Improved input access.

Table 4: Improved input access.

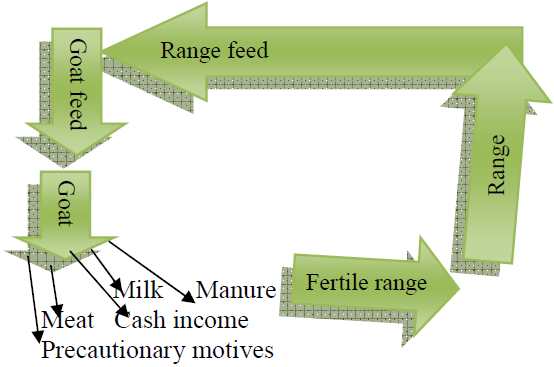

Problems in increasing production were contributed by different factors. These were veterinary, management practices, market information, and market infrastructures. The natural range flow is stated were the customize system applied [Diagram 2].

Poverty in pastoral areas is mainly related with expansion of economic opportunities, empowerment of poor to take advantage of new opportunities and lack of effective safety net to reduce vulnerability to protect poorer of the poor. Poverty is primarily caused by low level of assets holding coupled with low and uncertain productivity. Goats are considered to be major assets of pastoral communities in sample district households for livelihood support in general. As distribution of number of head holdings is highly skewed towards medium and large scale pastorals production system, yet; goat production are considered to be the potential options for poor households to earn their livelihood on sustainable basis.

Goat production was a very important activity in the study area. Flock sizes averaged 11.8 (std. dev = 33.8) per house-hold in this study. Goats are the main constitutes in the pastoral production though the poor have less number of herds. Goat per household in Afar regional state on average is estimated 15.8 (std. dev = 16.5) when compared to the sample households taken in Somalia and Oromia regional state Afar pastorals have a good per head holdings of goat which the F-value states that there is a significant differences at 5% [Table 5].

| Districts | Goat |

| Afar (Amibar, Chifra and Ewa) | 15.8 (16.5) |

| Oromia (Meiso, Babilea and,Fentalea) | 7.4 (2.3) |

| Somalia (Jigjiga and Kebribeyah) | 10.3 (5.8) |

| Total | 11.8 (33.8) |

| T-value | 2.6** |

Note: Figures in parenthesis are standard deviations

*** Significance at 1%, **, 5% and *, 10% Source: Survey result, 2014/15.

Table 5: Proportion of holding at household level.

*** Significance at 1%, **, 5% and *, 10% Source: Survey result, 2014/15.

Table 5: Proportion of holding at household level.

The average supply of goat on weekly based per household in the sample region varies significantly this may have direct or indirect relationship to the household holdings of goat or there might be other factors influencing the supply yet keeping constant factors in the region the household supply 2.7 (std. dev = 1.9). Weekly based market supply of the household to the market was found for their demands of house consumption and other expenses [Table 6]. This study as it focus on supply value chain it does not focus on determinants of the quantity accordingly supply dynamic are affected by inter and intra elements in the pastoral communities of Ethiopia.

| Districts | Goat |

| Afar (Amibar, Chifra and Ewa) | 2.7 (1.3) |

| Oromia (Meiso, Babilea and,Fentalea) | 1.9 (2.1) |

| Somalia (Jigjiga and Kebribeyah) | 2.3 (1.6) |

| Total | 2.7 (1.9) |

| T-value | 4.3*** |

Note: Figures in parenthesis are standard deviations;

*** significance at 1%, ** 5% and * 10%; Source: Survey result, 2014/15

Table 6: Average supply per household.

*** significance at 1%, ** 5% and * 10%; Source: Survey result, 2014/15

Table 6: Average supply per household.

The main reason stated by the sample pastoral households for not supplying live goat is the low level of production per household families and its contribution in the wealth status ranking at the community level with pre-questionnaires motives of risk [Table 7]. The others imperative explanations for not supplying were lack of demand which trigger competitiveness of the district markets, accessibility with the necessaries infrastructural development for traders and level price for their goats. From the sample taken 1200 pastoral household heads 87% and 91% indicated reasons for not supplying their live goat to the market is because of less holding and price are not rewarding for their supplies. The less number of holding can have different reasons as the key informant discussion stated like recurrent drought, range degradation, increment of family size as they have to share when children are marring and depart from the family.

| Variables | Percent Proportion for level of Importance | ||

| Very Important | Important | Less Important | |

| Less holding | 87 | 10 | 3 |

| Market distance | 22 | 4 | 74 |

| Price not rewarding | 91 | 8 | 1 |

| Wealth indicator | 69 | 22 | 9 |

| Risk motive | 31 | 19 | 50 |

Source: Survey result, 2014/15.

Table 7: Reasons for not supplying.

Table 7: Reasons for not supplying.

Structure of Goat Market

Value Chain Map

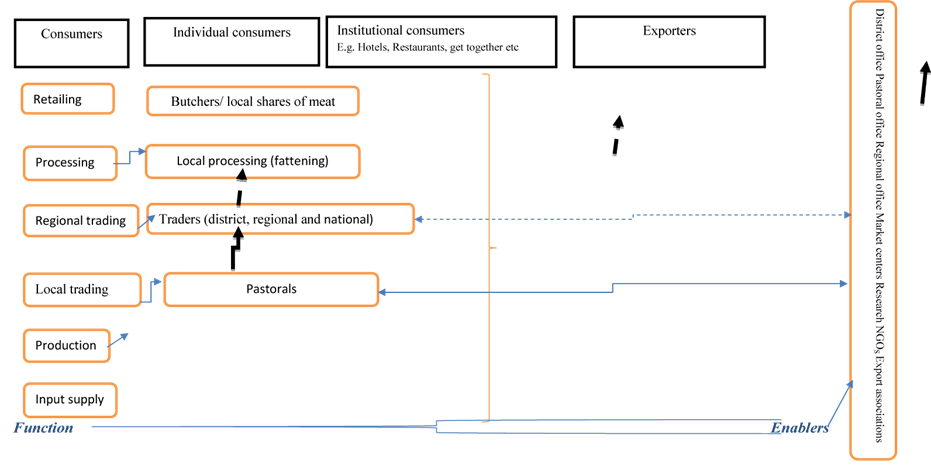

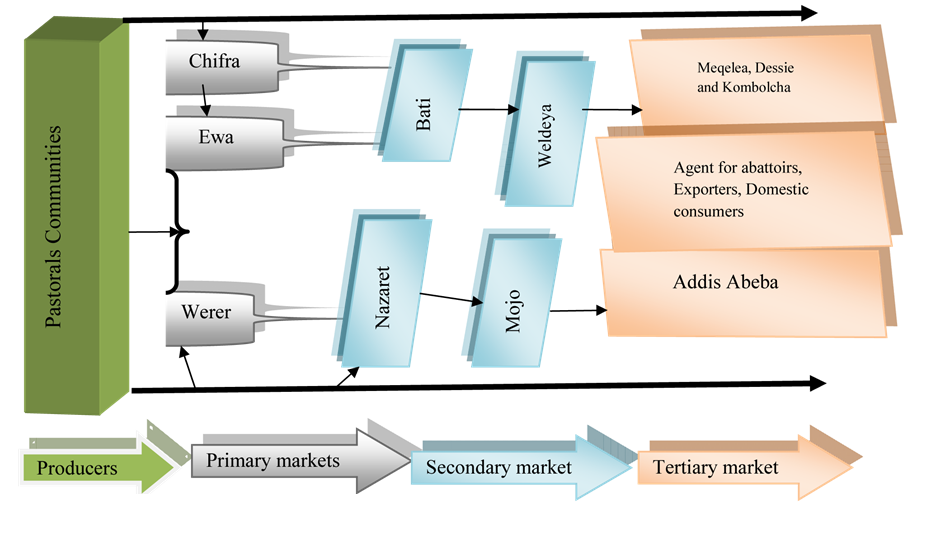

According to Mendoza (1995), channels are sequence of intermediaries through which live goat from producer to final and intermediary consumers. Figure 1 illustrates value chain map of goat in the pastoral communities. It presents various functions, actors and enablers of chain.

According to Mendoza (1995), channels are sequence of intermediaries through which live goat from producer to final and intermediary consumers. Figure 1 illustrates value chain map of goat in the pastoral communities. It presents various functions, actors and enablers of chain.

Major functions in the chain were input supply, production potentials and local traders at district level; collection, domestic trading and supply to the distance market were at trader level; and preliminary processing, and value addition by butchering at regional and national level with limited practice [Diagram 3].

The actors in relation to live goat value chain are described below:

Input suppliers: Mutual inputs to the pastoral producer were salt, concentrates feeds in few, veterinary medicines, fodder tree, which are mainly managed and supplied by agro vets, research centers, agricultural office and non-governmental agencies. Yet flow of inputs and knowledge/technology are limited. For traders, handling related materials such as rope, holding places with limited feeds and forages are major inputs.

Pastorals: Pastoral refers to a person who had been keeping and selling goat and whose livelihood depend on livestock production and major source income was from it. Two types of pastoral are engaged in goat production: [1] small scale pastoral scattered and low level of production and number of holdings are small; [2] semi-commercial characterized by availing technological application like concentrated feed, medication, and other necessary inputs. The holding capacity depends on different parameters which out of the objective this research yet this pastorals targeting market and livelihood sustainability in livestock production. Goat supply vary depends on holdings and motive.

Butchers: Are either unorganized and perform business seasonally especial in festivals of Christians and Muslims. Local butchers directly buy goats from the producers or collectors; often hold in their own collection/holding center in order to supply as per the local demand. In some cases they also deal with selling to large buyers/traders and serves as an intermediaries.

District traders: Three types of traders had been found: [1] direct buyers, collectors working to supply for traders or to send for their distance buyers (Nazreath, Mojo, Addis Ababa, Dessie, Kombelcha, Woldeya, Mekele) as quickly as possible with their agents in the destination to deal with the further selling activities, (2) those who collects from pastoral villages and involves in transaction process by taking goats to regional towns and cities such as Nazareth, Mojo, Addis Ababa, Dessie, Kombelcha, Woldeya and Mekelle, (3) those who collects goats from pastoral house on in door purchase and supply in roadcorridors open market; sell to local butchers, to restaurants and often sends some goats to distance market.

Sub-national traders: These categories handle and retail collected goats at sub-national/regional centers. Process include live goat selling to the butchers/fresh corners in cities like Addis Ababa and Mekelle.

National traders: Who had been active in value chain of live goat trade and they collect from district traders and sell in tertiary market mainly to fresh corners and even for exporters or they can export themselves.

Retailers: are fresh corners meat supplies directly to household consumers, restaurants, hotels in regional cities. This is one of end consumers from national perspectives traditional market system. Some fresh houses in Nazreat, Mojo, Kombolcha, and Addis Ababa are involved in processing of meat. Processing usually consist of cleaning, removing head and legs and wrapping in plastic for storage. The meat is stored in deep freeze for longer time and is delivered to customer mainly to regional towns and cities using the insulated vans.

Enablers and facilitators: their major purposes include public research and technology development, agreement on professional standards/rules/norms; provide promotional services through extension activities, advocacy and other related service providers.

Enablers in production and local level butchering

Pastoral bureau, agricultural research center and NGOs are mainly working to develop and disseminate different production and management technologies. Co-operatives often involved facilitating production activities. In the production process; microfinance institutions and cooperatives backing traders in providing loan yet such practices are slowly emerging. Goat production is a dynamic activity that requires substantial attention to feed, house and breed management. Thus gender roles and involvement are mostly done in a mutual understanding instead of men only or women only. Due to lack of enough feed resources, often medium level resource holding pastoral are more inclined to goat production rather than resource poor but it is not limited to resource rich only. Financial and technical access in terms of women, poor and marginalized is not visible at household level that is taking the shape of joint involvement for prominent activities.

Pastoral bureau, agricultural research center and NGOs are mainly working to develop and disseminate different production and management technologies. Co-operatives often involved facilitating production activities. In the production process; microfinance institutions and cooperatives backing traders in providing loan yet such practices are slowly emerging. Goat production is a dynamic activity that requires substantial attention to feed, house and breed management. Thus gender roles and involvement are mostly done in a mutual understanding instead of men only or women only. Due to lack of enough feed resources, often medium level resource holding pastoral are more inclined to goat production rather than resource poor but it is not limited to resource rich only. Financial and technical access in terms of women, poor and marginalized is not visible at household level that is taking the shape of joint involvement for prominent activities.

Pastorals supply goats; on door or to nearest district market. The district market suppliers are regarded by political boundaries because of natural resource conflicts (range conflicts, watering spot conflicts) for instance the Somalies and the Kereyus (from Oromia Fentalea) cannot supply to the market in Afar region keeping constant of distance factors resource scarcity and movement of pastoralism life has created a hostility among the sample regional states which is affecting the supply chain at the niche market level.

Goat passes consecutively through several market actors in the supply chain, inferring a different links in the value chain. Yet chains can be simple and easy for instant when pastorals supply to the household consumption may be at holidays and for daily based consumption.

Degree of market concentration

Goat market in the pastoral community’s results depicts that there is concentrated buyers. Concentration analysis was taken in the market of Chifra, Ewa and Amibara from Afar, Meiso, Babilie and Fentale from Oromia Jigjiga and Kebribeyah from Somalia. The analysis was calculated using the annual volume of demanded or sold head of got in the year of 2014/2015. The analysis indicates that traders were concentrated in Amibara market, Babilie and Fentale which showed that there were few buyers to absorb the supply of goat from the pastoral communities, local mini traders, collectors and fattening business owners.

Goat market in the pastoral community’s results depicts that there is concentrated buyers. Concentration analysis was taken in the market of Chifra, Ewa and Amibara from Afar, Meiso, Babilie and Fentale from Oromia Jigjiga and Kebribeyah from Somalia. The analysis was calculated using the annual volume of demanded or sold head of got in the year of 2014/2015. The analysis indicates that traders were concentrated in Amibara market, Babilie and Fentale which showed that there were few buyers to absorb the supply of goat from the pastoral communities, local mini traders, collectors and fattening business owners.

In Amibara woreda (specific market place of Werer countryside town), the highest share of the four trader that bought heads of goat share of the market is controlled over 91% over the total bought in the market at the market fiscal year, while in Babilie and Fentale 84% and 71% from the total head of goat purchased for different purposes the four largest traders occupied their shares of the market demand respectively. Bhaskar, V. and T. (2003) also stated forms of market; and result indicates structure criteria that oligopoly market formation. These can result different forms of collusion, in return may have created arbitration in market furthermore; restrictive trade practices to raise prices and restrict supply, similar to the monopoly market system creating cartel and taking price leadership. Price determination will encourage supplier.

| Sample Markets | Concentration index top Four Traders |

| Amibara | 91.4 |

| Ewa | 54.2 |

| Chifra | 58.1 |

| Meiso | 55.1 |

| Babilie | 83.7 |

| Fentale | 70.9 |

| Jigjiga | 60.4 |

| Kebribeyah | 59.7 |

Source: Survey result, 2014/15.

Table 8: Concentration ratio for primary markets.

Table 8: Concentration ratio for primary markets.

Marketing Cost and Margin of Goat

Marketing cost of goat

Performing on market has different direct and indirect costs to be incurred throughout destination so this study has considered different average costs of live goat transaction by assemblers and wholesalers. Argument on marketing cost and margin commonly include transaction competence; a competent market is capable of moving goat from producer (pastoral communities) to customer at the lowest cost consistent with provision of goat that consumers demand. Once transaction costs are identified then different means can be devised to make the system more efficient. Value chain efficiency can be achieved in different parametrical ways these can be: by increasing volume of business using improved handling methods, investing in modern technology, locating business in most appropriate place, implementing better layouts and working practices in production, improving managerial planning and control and making changes in marketing arrangements (e.g. through horizontal or vertical integration).

Marketing cost of goat

Performing on market has different direct and indirect costs to be incurred throughout destination so this study has considered different average costs of live goat transaction by assemblers and wholesalers. Argument on marketing cost and margin commonly include transaction competence; a competent market is capable of moving goat from producer (pastoral communities) to customer at the lowest cost consistent with provision of goat that consumers demand. Once transaction costs are identified then different means can be devised to make the system more efficient. Value chain efficiency can be achieved in different parametrical ways these can be: by increasing volume of business using improved handling methods, investing in modern technology, locating business in most appropriate place, implementing better layouts and working practices in production, improving managerial planning and control and making changes in marketing arrangements (e.g. through horizontal or vertical integration).

| Participants | Regional whole Sealers |

Retailer | Pastorals | Pre-Urban Assemblers (Fatteners) |

| Load | 2.50 (1.6) | 5.69 (18.29) | - | 2.50 (4.34) |

| Unload | 3.35 (2.1) | - | - | 2.95 (5.12) |

| Brokerage | 9.11(5.7) | 7.60 (24.43) | - | 6.50 (11.27) |

| Vehicle | 15.55 (9.7) | - | - | 11.42 (19.81) |

| Sorting wage | 2.75 (1.7) | 3.17 (10.19) | - | 1.75 (3.04) |

| Storage | 1.05 (0.7) | 6.78 (21.79) | - | 1.11 (1.93) |

| Guard | 1.01(0.6) | 2.35 (7.55) | - | 1.75 (3.04) |

| Telephone | 15.08 (9.4) | 0.60 (1.93) | 5.5 (20) | 12.10 (20.99) |

| Other expense | 12.12 (7.6) | 2.29 (7.07) | 17 (61.81) | 11.70 (20.29) |

| Tax and levies | 8.64 (6.1) | 2.63 (8.45) | 5 (18.18) | 5.87 (10.18) |

| Total cost | 71.16 | 31.11 | 27.5 | 57.65 |

Note: In parenthesis percentage are share of transaction cost from total marketing cost.

Source: Survey result, 2014/15.

Table 9: Average marketing cost (Eth. Birr/head).

Source: Survey result, 2014/15.

Table 9: Average marketing cost (Eth. Birr/head).

Marketing margin for goat

| Marketing Margin | Channel I (Somalia, Oromia, Afar to Amhara(Woldia)-Tigray) |

Channel II (Somalia, Oromia, Afar to Addis Ababa) |

| GMMRhs | 12.7 | 16.2 |

| GMMRt | 15.1 | 36.4 |

| GMMpp | 21.6 | 35.5 |

| GMMPua | 11.2 | 19.9 |

| NMMRhs | 8.7 | 15.2 |

| NMMRt | ||

| NMMPua | ||

| TGMM |

Note: Rhs- regional whole sealers; Rt-retailers; Pp-pastoral; Pua-pre-urban assemblers.

Source: Survey result, 2014/15.

Table 10: Marketing margin for goat.

Table 10: Marketing margin for goat.

Market Integration Analysis

Correlation Coefficients

Econometric analysis signifying the existence of relationship among two different markets is correlation by using the real price exchange at the market level. The buck and doe was estimated using simple correlation coefficient. Five market (Amibara, Chifra, Fentale, Jigjiga and Babilie) where taken for the ten pair correlations were tested and the result indicated that significantly prices were integrated. Spatial goat (buck) market pairs were identified by levels of strength (i.e. strong, moderate, and weak), by the price paid [Table 11]. In accordance with this analysis, Babilie-Jigjiga was strongly integrated with 0.86 and Amibara-Chifra market were moderately integrated with 0.71 and Chifra-Jigjiga was found have no integration in grade fat buck. With moderate grade of buck recording the weak correlation coefficient was recorded at Amibara-Fentale (0.52) and Fentale-Babilie (0.48) was (r < 0.6) but positively correlated. Yet, it was difficult to estimate existence of price integration between spatially separated pairs using the correlation measures.

Correlation Coefficients

Econometric analysis signifying the existence of relationship among two different markets is correlation by using the real price exchange at the market level. The buck and doe was estimated using simple correlation coefficient. Five market (Amibara, Chifra, Fentale, Jigjiga and Babilie) where taken for the ten pair correlations were tested and the result indicated that significantly prices were integrated. Spatial goat (buck) market pairs were identified by levels of strength (i.e. strong, moderate, and weak), by the price paid [Table 11]. In accordance with this analysis, Babilie-Jigjiga was strongly integrated with 0.86 and Amibara-Chifra market were moderately integrated with 0.71 and Chifra-Jigjiga was found have no integration in grade fat buck. With moderate grade of buck recording the weak correlation coefficient was recorded at Amibara-Fentale (0.52) and Fentale-Babilie (0.48) was (r < 0.6) but positively correlated. Yet, it was difficult to estimate existence of price integration between spatially separated pairs using the correlation measures.

| Markets | Buck Fat | Buck Moderate | Buck Thin |

| Amibara- Chifra | 0.71** | 0.91** | 0.19* |

| Amibara-Fentale | 0.68** | 0.52* | 0.59* |

| Amibara-Jigjiga | 0.03 | 0.13 | 0.08 |

| Amibara -Babilie | 0.14 | 0.31* | 0.06 |

| Chifra –Fentale | 0.11 | 0.02 | 0.00 |

| Chifra-Jigjiga | 0.00 | 0.01 | 0.00 |

| Chifra-Babilie | 0.01 | 0.00 | |

| Fentale-Jigjiga | 0.20* | 0.27* | |

| Fentale-Babilie | 0.39* | 0.48* | |

| Babilie-Jigjiga | 0.86** | 0.98** | 0.62* |

Note: Correlation coefficients if strong (r > 0.8), moderate (0.6 < r < 0.8) and weak (r < 0.6). **Correlation is significant at 0.01 levels; *Correlation is significant at 0.05 levels.

Source: price data computed, 2013-2015.

Table 11: Correlation coefficient.

Source: price data computed, 2013-2015.

Table 11: Correlation coefficient.

Spatial integration trends

The buck and doe market integration was analyzed by the signal and scale of trend factor in the weekly spatial price spread. In absolute term integration trend coefficient signify extent and speed of integration. The higher absolute result; indicates better speed of the market to integrate in given period of time and vice versa.

The buck and doe market integration was analyzed by the signal and scale of trend factor in the weekly spatial price spread. In absolute term integration trend coefficient signify extent and speed of integration. The higher absolute result; indicates better speed of the market to integrate in given period of time and vice versa.

Market pairs were found positively trend of spatial price spread in fat grade; indicating that there was integrating over the past three years [Table 12] Amibara-Chifra (0.07) and Babilie-Jigjiga (0.08) with significant level of 1%, while some of the sample markets were closer to arbitrage formation Chifra-Jigjiga (-0.2). In moderate body condition of buck Amibara-Chifra (-0.01) and Amibara-Fentale (-0.03) integrated; though it was not showed with degree of improvement which the trend coefficient was negative.

| Market Pairs | Buck Fat | Buck Moderate | Buck Thin | |||

| Cons. | Trend Coef. | Cons. | Trend Coef. | Cons. | Trend Coef. | |

| Amibara- Chifra | 5.81** | 0.07** | 2.49** | -0.01* | 0.49 | -0.01* |

| Amibara-Fentale | 6.16** | 0.09** | 3.15** | -0.03* | 0.17 | -0.00 |

| Amibara -Babilie | 1.10 | 0.00 | 1.53 | 0.00 | 0.62 | 0.00 |

| Chifra –Fentale | 1.11 | 0.04 | -1.17 | 0.01* | 1.28 | 0.01* |

| Chifra-Jigjiga | 0.02 | -0.2* | 0.42 | 0.00 | 1.09 | 0.01 |

| Chifra-Babilie | 0.63 | -0.03** | 0.04 | 0.00 | -0.96 | 0.03** |

| Fentale-Jigjiga | 0.23 | 0.00 | -0.71 | 0.00 | 0.00 | 0.00 |

| Fentale-Babilie | 0.35 | 0.05 | 0.22 | 0.00 | 0.00 | 0.00 |

| Babilie-Jigjiga | 7.11** | 0.08** | 6.43** | 0.09** | 2.14* | 0.49** |

Note: VEC Correlations of autocorrelation were conducted for all market pair.

**Significant at 0.01; *Significant at 0.05.

Source: price data computed, 2013-2015.

Table 12: Trend in spatial price spread.

**Significant at 0.01; *Significant at 0.05.

Source: price data computed, 2013-2015.

Table 12: Trend in spatial price spread.

Causal test OLS

During this study of integration the trend of price information flows were tested by the Granger causality assessment, assuming that there exists a central market among the sample marketplace considered (Nazareth and Woldia).

H0 = Coefficient lag of Pij = 0

H1 = Coefficient lag of Pij ≠0

During this study of integration the trend of price information flows were tested by the Granger causality assessment, assuming that there exists a central market among the sample marketplace considered (Nazareth and Woldia).

H0 = Coefficient lag of Pij = 0

H1 = Coefficient lag of Pij ≠0

There was a reasonable justification that Granger-cause of Amibara buck with grades of fat on Nazareth market with significant cause effect to price at lag 2 with (1%) having adjusted R squared value of 0.71; which was explaining effect with rejection of the null hypothesis, while the vice versa with lag 2 at significant level of (5% and above) Nazareth cause effect on Amibara in 4.30 F-value. So causation is a feedback from the two markets at (5%) with strong Granger cause from former. Fentale market to caused influence on Nazareth market was very weak (with significant level of 10% and above). This might be for different reasons like adjacent markets influence to Nazareth market flow of causal effects; further more as supply flow was from various directions and demand for buck might be satisfied while existence of a price shock from Fentale market was at move [Table 13].

| Market Pair | Lag | Causality (F-test) |

P > F | Adiusted- R2 | Market Pair | Lag | Causality (F-test) |

P > F | Adiusted- R2 |

| Nazareth- mibara | 1 | 4.89** | 0.00 | 0.71 | Woldia- Amibara | 2 | 3.66* | 0.03 | 0.62 |

| Nazareth-Chifra | 3 | 4.69* | 0.03 | 0.53 | Woldia-Chifra | 1 | 4.40** | 0.01 | 0.82 |

| Nazareth-Fentale | 1 | 2.43* | 0.05 | 0.78 | Woldia-Fentale | 4 | 3.91* | 0.04 | 0.58 |

| Nazareth-Meiso | 2 | 4.30* | 0.04 | 0.51 | Woldia-Meiso | 4 | 4.12* | 0.05 | 0.62 |

| Nazareth-Babilie | 4 | 3.15* | 0.03 | 0.55 | Woldia-Babilie | 3 | 3.84* | 0.05 | 0.59 |

| Nazareth-Jigjiga | 5 | 4.14* | 0.02 | 0.41 | Woldia-Jigjiga | 4 | 2.12* | 0.05 | 0.41 |

| Amibara-azareth | 2 | 4.78** | 0.00 | 0.63 | Amibara-Woldia | 4 | 7.39* | 0.03 | 0.57 |

| Chifra –Nazareth | 4 | 2.11* | 0.16 | 0.31 | Chifra –Woldia | 1 | 6.01* | 0.02 | 0.93 |

| Fentale-Nazareth | 1 | 1.62* | 0.12 | 0.66 | Fentale-Woldia | 6 | |||

| Meiso -Nazareth | 4 | 2.78* | 0.04 | 0.44 | Meiso -Woldia | 5 | |||

| Babilie-Nazareth | 6 | 3.18* | 0.05 | 0.38 | Babilie-Woldia | 6 | |||

| Jigjiga-Nazareth | 6 | 2.89* | 0.05 | 0.33 | Jigjiga-Woldia | 6 |

** Causality is significant at 0.01; * Causality significant at 0.05.

**Causality is significant at 0.10 (weak); *Causality is significant at 0.25 (very weak).

Source: price data computed, 2013-2015.

Table 13: Granger causality test of buck grades of fat OLS.

**Causality is significant at 0.10 (weak); *Causality is significant at 0.25 (very weak).

Source: price data computed, 2013-2015.

Table 13: Granger causality test of buck grades of fat OLS.

Test for Unit root

Tests for unit root was used to determine if trending data should be first differenced or regressed on deterministic functions for stationary. Moreover, economic theory suggests the existence of long-run equilibrium relationships among non-stationary on time series variables.

Tests for unit root was used to determine if trending data should be first differenced or regressed on deterministic functions for stationary. Moreover, economic theory suggests the existence of long-run equilibrium relationships among non-stationary on time series variables.

Yt = α +βPt-1 + εt 6

H0: The price series = unit root

H1: The price series ≠ non-unit root

H1: The price series ≠ non-unit root

Augmented Dickey Fuller (ADF) test: Regress first difference on a constant; first periods lag and several lags of the first differenced series. The numbers of lagged first difference was chosen so as to remove all traces of higher order residual autocorrelation. The optimal lag length for each market price series was automatically determined using Akaike Information Criterion (AIC).

H0: Pt = Pt-1 + εt

H1: ΔPt = Pt-1 (P-1) + Pt-2 (P-2) + Pt–n (p-n) + εt

H1: ΔPt = Pt-1 (P-1) + Pt-2 (P-2) + Pt–n (p-n) + εt

Tau (τ) statistics registering low p-value; the null hypothesis of non-stationary can be rejected. Without transformed series testing, all τ-values of ADF statistics show highly significant results indicating stationarity of D at different lag. Hence without shadow of doubt, the sampled market price series are I (lags) and their first difference are I (1) tested for comparisons.

Results of unit root test show that prices were stationary differencing orders integration in Amibara, Chifra, Fentale, Meiso, Babilie, Jigjiga, Nazareth and Woldia, demonstrating order of integration in weekly prices of order one, for Amibara and Fentale while I (2) showing in absolute term the higher τ- value of 5.11 and 5.78 while I (3) for Chifra and Nazareth with τ- value of 3.45 and 6.44 ; ADF test statistics greater than critical values of (1%), (5%) and (10%) of the interpolated Dickey-Fuller in absolute term and the Mackinnon P-value approximates to zero so that the null hypothesis of unit root was rejected in favor of stationarity alternative with buck in grade of fat Table (14). At significant level of (1%) for Amibara, Fentale and Nazareth while (5%) for Chifra indicating no unit root. In an AR (Autoregressive) for buck price for grade of fat, a one-time shock affects values evolving variable infinitely far into the future. Consider the AR (lag) model Pt = + α + φ1Pt-1 + εt. A non-zero value for εt at time t1 = first week affects P1 by the amount ε1. Then the AR equation for P2 in terms of P1, affects P2 by φ1ε1. Then the AR equation for P3 in terms of P2, affects P3 by φ12 ε1. This process shows that effect of ε1 never ends, although the process was stationary yet the effect diminishes toward zero in the limit;

Because each shock affects Pb (price of buck) values infinitely far to the future from when they occur P0, any given value Pt is affected by shocks occurring infinitely far to the past in the sample pastoral communities.

| Market | Lag | τ -value | Mackinnon P-value | X2 @ 10 lags (P > X2) |

| Amibara | 2 | - 5.11*** | 0.00 | 13.01 (0.01) |

| Chifra | 3 | -3.45** | 0.04 | 8.26 (0.54) |

| Fentale | 2 | -5.78*** | 0.00 | 21.17 (0.01) |

| Meiso | 4 | -3.17** | 0.05 | 7.15 (0.71) |

| Babilie | 5 | -3.01** | 0.03 | 8.66 (0.57) |

| Jigjiga | 6 | -2.02* | 0.06 | 5.99 (0.91) |

| Nazareth | 3 | -6.44*** | 0.00 | 31.19 (0.00) |

| Woldia | 6 | -3.56** | 0.05 | 8.92 (0.78) |

Note: Lag length was determined based on significance level of lag structure ***, ** and * indicate significance at 1%, 5% and 10%, τ-value in parenthesis, X2 = Durbin's alternative test of serial correlation, values in parenthesis show significance level to reject null hypothesis (H0: No autocorrelation).

Source: Own data computed, 2013-2015.

Table 14: Test of unit root buck grades of fat.

Source: Own data computed, 2013-2015.

Table 14: Test of unit root buck grades of fat.

White noise was a stationary process and there were a useful generalization of random walk which requires that first difference was stationary with flat signal spectrum frequency:

ΔPt = εt, εt is stationary

ΔPt = εt, εt is stationary

Random Walk (Pt = Pt-1 + εt)

It predicts that price at time t will be equal to the last period price plus a stochastic component that was a white noise, which means εt is independent and identically distributed with mean zero and variance "σ²". It can also be named a process integrated of some order, a process with a unit root or a process with a stochastic trend.

It predicts that price at time t will be equal to the last period price plus a stochastic component that was a white noise, which means εt is independent and identically distributed with mean zero and variance "σ²". It can also be named a process integrated of some order, a process with a unit root or a process with a stochastic trend.

Such a Pt was integrated order 1 and noted I (1). The white noise test refers to the fact that the buck with grade of fat does not have autocorrelation which supports the unit root test using ADF. In this analysis the null hypothesis which sates no serial correlation was rejected while the alternative hypothesis existence of serial correlation accepted as the result of (Table 15), the white noise test describes that there is no unit root for stochastic trend. The values of probability greater than Durbin’s alternative test for serial correlation signify high degree of significant at (0.01%).

| Portmanteau test for white noise | ||||

| Portmanteau/Q/Statistic @level | P > X2 | Portmanteau/Q/ Statistic @ lag 6 |

P>X2 | |

| Amibara | 2011.02*** | 0.01 | 1491.53*** | 0.00 |

| Chifra | 979.66** | 0.04 | 1241.79*** | 0.00 |

| Fentale | 4633.12*** | 0.00 | 2628.12*** | 0.00 |

| Meiso | 712.74** | 0.05 | 1724.11*** | 0.00 |

| Babilie | 1398.41** | 0.03 | 2001.41*** | 0.00 |

| Jigjiga | 1726.12** | 0.05 | 1772.19*** | 0.00 |

| Nazareth | 2137.49*** | 0.01 | 3078.42*** | 0.00 |

| Woldia | 1006.22** | 0.03 | 503.47*** | 0.00 |

Note: X2 = Durbin's alternative test for serial correlation.

*** Significance at 1 %; ** significance at 5%; * significance at10%.

Source: price data computed, 2013-2015.

Table 15: Test of white noise for buck grades of fat.

*** Significance at 1 %; ** significance at 5%; * significance at10%.

Source: price data computed, 2013-2015.

Table 15: Test of white noise for buck grades of fat.

Co-integration test

Econometric co-integration of prices

Market price series were integrated of order I (1) and their respective difference were non stationary at order differencing, or I (lag), the stage was now clear to test for bivariate co integration of eight distinct pair wise combinations of goat markets. These tests were the Engle- Granger test of VAR model, Maximum Eigenvalue and Trace Statistics tests considering Amibara, Chifra, Fentale, Meiso, Babilie, Jigjiga, Nazareth and Woldia goat markets.

Econometric co-integration of prices

Market price series were integrated of order I (1) and their respective difference were non stationary at order differencing, or I (lag), the stage was now clear to test for bivariate co integration of eight distinct pair wise combinations of goat markets. These tests were the Engle- Granger test of VAR model, Maximum Eigenvalue and Trace Statistics tests considering Amibara, Chifra, Fentale, Meiso, Babilie, Jigjiga, Nazareth and Woldia goat markets.

Pit = β0 + β1dPjt + εt 7

Where εt approaches to I (0)

Then there was a test for a linear combination the price in such a way that:

εt = Yit - β1dPjt - β0 will be stationary 8

Then there was a test for a linear combination the price in such a way that:

εt = Yit - β1dPjt - β0 will be stationary 8

Results of the Engle-Granger co-integration test (EG)

EG for integration test is based on two step, and it test for long run relationship between the price of the goat in the market considered with relation to the difference in sex and body conditions at the geographically separated markets. The EG (1987) test uses a more generalized formulation.

If β is a vector of coefficients and Pt is a vector of non-stationary variable then there will be a co- integration vector β such that:

βPt = εt 9

βPt = εt 9

Table 16 result of unit root test of residuals at test statistics with comparison to the critical values and considering the Macknnonian p-value to the test statistic after the OLS regression of the EG test. The table reveals that out of the possible pairs, the two routes produced stationary residuals at (1%, 5% and 10%) significant level for co-integration except producers market to each other for instant Chifra-Jigjiga the Macknnonian P-value shows (0.03) significance for the test statistic of 3.14 the critical value of (5%) with grade of fat. Market pairs show evidence of spatial integration. Pairs of market route were tied-up, thus were spatially integrated with high degree of integration Woldia–Chifra which has test statistic of 7.71, Nazareth-Fentale found to be 7.44 and Amibara-Fentale showed 6.25 in grade fat of buck.

The statistics reflected in [Table16] are Tau statistics of residuals of regressions to different market pairs. Being I (1), market price series were all stationary. Hence, regressions involving them may produce spurious results unless they are truly linked in a long run fashion. According to Engle and Granger (1987), if bivariate regressions featuring I (1) variables can generate I (0) residuals, the variables show evidence of long run equilibrium relationship as the result indicated.

| Goat | Markets | Amibara | Chifra | Fentale | Meiso | Babilie | Jigjiga | Nazareth | Woldia |

| Buck | Amibara | -3.14** | -6.25*** | -2.40* | 2.01* | -2.11* | -4.62*** | -2.03* | |

| Chifra | -4.16*** | -3.10*** | 2.00* | 1.89* | -0.03 | -2.53* | -4.77*** | ||

| Fentale | -6.15*** | -4.13*** | -4.44*** | -3.19** | -3.10** | -6.15*** | -0.20 | ||

| Meiso | -1.20 | -0.31 | -3.18** | -4.21*** | -3.33** | -3.11** | -0.11 | ||

| Babilie | -0.82 | -0.21 | -3.07** | -2.00* | 5.22*** | -1.29 | -0.33 | ||

| Jigjiga | -0.95 | 0.12 | -2.32* | -2.47* | -4.78*** | -2.33* | -0.21 | ||

| Nazareth | -6.21*** | -3.09** | -7.44*** | -4.12*** | -.2.37* | -2.21* | -6.57*** | -2.31* | |

| Woldia | -4.17*** | -7.71*** | -3.25** | -3.33** | 3.89*** | -2.75* | -2.55* |

Significance at 1%; **5% and * 10%.

Source: Price data computed, 2013-2015.

Table 16: Engle-Granger co-integration two step OLS and unit root grade of fat.

Table 16: Engle-Granger co-integration two step OLS and unit root grade of fat.

Conclusion and Recommendations

Goat production is the most common ruminants in pastoral communities of Ethiopia. Goat keeping is an integrated approach for majority of Ethiopian pastorals as they keep goats as part of the livelihood system. It is also regarded as the handy source of money in need and is considered to be attractive for poverty reduction and improvement of family food security and livelihood of the poor. Creating competitive market for goat can have an opportunity to fetch good price which will have an impact on purchasing power of pastoral households to convert cash income for nutritional food needed for consumption and other amenities.

Since pastoralism is a way of life depends on the movement for search of feed for their livestock; the production system was found to be more of a traditional system with communal land for range.

This research has analyzed constraints and opportunities of the chain in order to arrive to some possible intervention measures for development and research. Constraints that also cover specifically for sample communities regarding goat production were:

- Less development in technologies related to pastoral system for commercial orientation; as stated from the key informant’s discussion there is not any market oriented system of production in communities. Addressing the problem with development and research can create an opportunity more supply to market demand further this trigger sustainable income generation.

- Lack of goat resource center to supply elite doe and buck to the pastoral; having such a center will create an advantage for the pastoral to dictate production system to the market orientation.

- Poor facility of loan disbursement from government part to both producers and traders; this hider’s development of the value chain with capacity to facilitate transaction, competition.

- Transportation means undefined; since pastoral communities are dissociated from cities and towns accessing pastoral market destination are difficult; yet there are improvements but needs a focus for development to supply and demand chain.

- Price information; most pastoral communities have no access to different market information especially on the tertiary market which leads to arbitrage of the market and few concentrated buyers that can affect the price determination and market clearing which leads to oligopoly market system.

- Opportunities for sector development include:

- There are emerging rendering health service through private business such as agro-vets, and related shops that are opening even in remote parts of communities; this will create an opportunity for supplying healthiest goats.

- Potentiality for large scale commercial business intervention; there is access to public land for leasing to serve as large ranch production system.

- Existing opportunities to improve marketing system even in remote parts due to developing road corridors which would mean to have an easy access for transportation production means as well as flow of live goats to secondary and tertiary market.

- There exist potentials to strengthen producers’ group and their activities for large scale of dealing whereas associations of traders (if developed) would pave ways to regulate policies and make enabling environment.

- Analyzing constraints and opportunities, the suggested interventions include both short and longterm. Accordingly, short-term interventions include:

- Development of fodder trees in irrigation access districts like Afar, Oromia and Somalia; this will enter for fattening development in the future with demanding weight.

- Research and Development intervention related to veterinary health care, such as dipping against ecto-parasites and supply of medicines against indo-parasites, foragefodder seeds scaling out can solve some the constrains in supplying the necessary live goat to market.

- Establishing collection centers with facilities of larger scale of holding scheme to maintain their body weight against handling and transportation loss; this can solve supply of demanded weight in tertiary market or exportable demand.

- Long-term interventions include:

- Establishing community based goat resource centers that can fit the market demand in weight and other necessary parameters. Organizing progressive pastorals in respective potential and established pocket areas to elite doe and buck can attract demand for competition. This needs training on scientific breeding plan along with help for preparing scheme of resource center development like werer agricultural research center, Afar pastoral and agro-pastoral research institutes, Somalia pastoral and agro-pastoral research institutes; can help in attaining the necessary development of supply chain.

- Support to in-depth study aiming to explore climate and niche specific potentials to increase overall production so that larger scale supply would be possible to establish in the future; as demand for meat is increasing to national and international market.

- Introduction of production insurance/animal-health protection scheme to safeguard investment and attract large scale entrepreneurs into the chain. As joint involvement of men and women for goat rearing is prominent regardless of social strata, gender roles and ethnicity, gender and social inclusiveness related specificities are visible yet not spell out in detail in terms of constraints and opportunities. Moreover, challenge lies to increase existing scale of production, especially with agglomeration effects of road and other infrastructural developments.

Acknowledgement

I am grateful to the Feed the Future Innovation Lab Project, Adapting Livestock to Climate Change Colorado State University and Ethiopian Institute of Agricultural Research for financial and material support for this research. It is my humble pleasure to extend thanks to my major mentor, Professor Dana Hoag, who supervised me so closely throughout the realization of this research. I would like to thank him for directing me to the most important aspects of methodology, drawing up my attention in several aspects of the research and devotion of his time to correct the paper. His comments were so perceptive, helpful, and appropriate. It is also my pleasure to thank my Dr. Solomon Desta and Dr. Getachew Gebru for their scientific support and guidance at the time of need.

I am grateful to the Feed the Future Innovation Lab Project, Adapting Livestock to Climate Change Colorado State University and Ethiopian Institute of Agricultural Research for financial and material support for this research. It is my humble pleasure to extend thanks to my major mentor, Professor Dana Hoag, who supervised me so closely throughout the realization of this research. I would like to thank him for directing me to the most important aspects of methodology, drawing up my attention in several aspects of the research and devotion of his time to correct the paper. His comments were so perceptive, helpful, and appropriate. It is also my pleasure to thank my Dr. Solomon Desta and Dr. Getachew Gebru for their scientific support and guidance at the time of need.

My sincere thanks go to the staff of Werer Agricultural Research Center. Many thanks to all of you who I have not mentioned here but in one way or another contributed to my desire to complete this research.

References

- Asfaw N. “Vertical and spatial integration of grain markets in Ethiopia: Implications for grain market and food security policies”. Working Paper 9 (1998): 10-25.

- Bressler RG and Richard A King. “Markets, Prices and Interregional Trade”. UNIVERSITY OF ILLINOIS (1978):

- Dickey DA and Fuller WA. “Distribution of the Estimators for Autoregressive Time Series; Distribution of the Estimators for Autoregressive Time Series with a Unit Root”. Journal of the American Statistical Association74.366 (1979): 427-431.

- Engle RF and CWJ Granger. “Co-integration and Error Correction: Representation, Estimation and

- Testing, Econometrical”. Econometrica 55.2: 251-276.

- Granger CWJ. “Investigating causal relationships by econometric models and cross spectra methods”. Econometrica 37.3 (1969): 424-438.

- Granger CWJ. “Some properties of time series data and their use in econometric model specification”. Journal of Econometrics 16.1 (1981): 121-130.

- Tom Engsted., et al. “Testing for multi co-integration”. Economics Letters 56 (1997): 259-266.

- Gujarati DN. “Basic Econometrics. 4th Edition”. McGraw-Hill (2004): 563-636.

- Johnston J and Dinardo J. “Econometrics Methods. 4th Edition”. Econometric Theory16.2000 (1997): 139-142.

- Kohl RL and Uhl JN. “Marketing of Agricultural Product, 5th Edition”. Collier Macmillan (1985): 624p.

- Mendoza MS and MW Rosegrant. “Price conduct of spatially differentiated markets”. Food and Agriculture Organization of the United Nations (2012): 343-357.

- ME Ensminger and R.O. Parker. “Goats disseminated all over the world because their great adaptability to varying environmental conditions and the different”.

- Oliver and Balcombe. “Price transmission in selected agricultural markets”. FAO COMMODITY AND TRADE POLICY RESEARCH WORKING PAPER7 (2004):

- Palaskas TB and B Harriss White. “Testing market integration: new approaches with case material from the west Bengal food economy”. The Journal of Development Studies 30.1 (1993): 1-57.